How To Calculate EBITDA | What is the formula to calculate EBITDA?

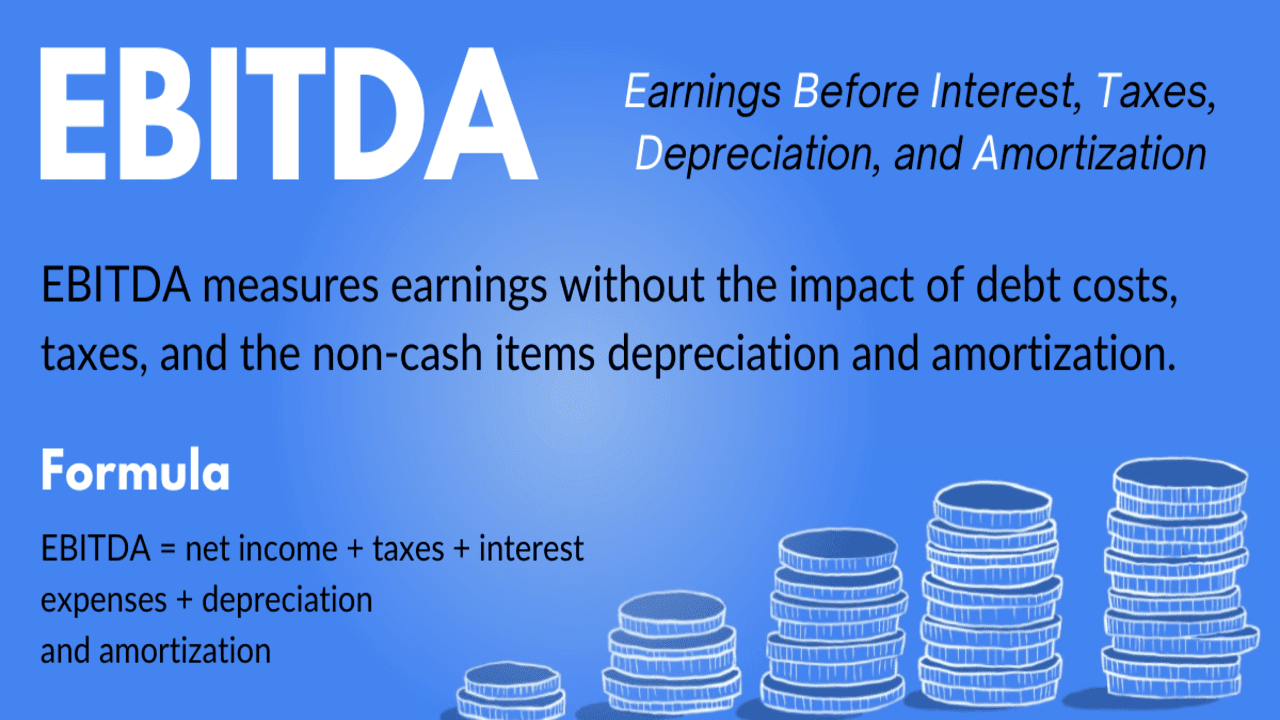

How To Calculate EBITDA | What is the formula to calculate EBITDA? EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization which is a way to evaluate a business’s profitability. The EBITDA metric is a variation of operating income (EBIT) that excludes certain non-cash expenses.

The purpose of these deductions is to remove the factors that business owners have discretion over, such as debt financing, capital structure, methods of depreciation, and taxes (to some extent).

Contents

What is EBITDA?

EBITDA, which stands for “earnings before interest, taxes, depreciation, and amortization,” is a calculation to find the income from the operations of a business by separating this income from non-operations variables. To understand this metric, which can better reflect the operating profitability and financial health of a business, it’s important to take a closer look at each component of the acronym.

What is the formula to calculate EBITDA?

It can be calculated in multiple different ways and is extensively used in valuation. Here is the formula for calculating EBITDA:

EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization = Net Income from Operations.

or

EBITDA = Operating Profit + Depreciation + Amortization

or

EBITDA = Revenue – Cost of Goods Sold (COGS) – “Normalized” Operating Expenses.

or

EBITDA = EBIT + Depreciation + Amortization.

or

EBITDA = Net Income + Taxes + Interest Expense + Depreciation + Amortization.

or

EBIT = Net Income + Interest + Taxes.

or

EBITDA = EBIT + Depreciation + Amortization.

How You Can Calculate EBITDA?

EBITDA can be calculated in multiple different ways and is extensively used in valuation. If a company doesn’t report EBITDA, it can be easily calculated from its financial statements. The earnings (net income), tax, and interest figures are found on the income statement, while the depreciation and amortization figures are normally found in the notes to operating profit or on the cash flow statement. The usual shortcut for calculating EBITDA is to start with operating profit, also called earnings before interest and taxes (EBIT), then add back depreciation and amortization.

1. Taxes

Taxes vary and depend on the region where the business is operating. They are a function of a jurisdiction’s tax rules, which are not really part of assessing a management team’s performance, and, thus, many financial analysts prefer to add them back when comparing businesses.

2. Depreciation & Amortization

Depreciation and amortization (D&A) depend on the historical investments the company has made and not on the current operating performance of the business. Companies invest in long-term fixed assets (such as buildings or vehicles) that lose value due to wear and tear.

3. Interest

Interest expense is excluded from EBITDA, as this expense depends on the financing structure of a company. Interest expense comes from the money a company has borrowed to fund its business activities.

Disadvantages of EBITDA

EBITDA is not recognized by GAAP or IFRS. Some are skeptical of using it because it presents the company as if it has never paid any interest or taxes, and it shows assets as having never lost their natural value over time (no depreciation or capital expenditures are deducted).

A common misconception is that EBITDA represents cash earnings. However, unlike free cash flow, EBITDA ignores the cost of assets. One of the most common criticisms of EBITDA is that it assumes profitability is a function of sales and operations alone—almost as if the company’s assets and debt financing were a gift.

What is a good EBITDA multiple?

Multiples are ratios used to compare potential investments that investors may be considering. To know if an EBITDA multiple is good, you must look at it compared to other similar types of businesses. For example, an average EBITDA/sales margin for the advertising industry is 17.39%, meaning that EBITDA is 17.39% of sales.

Some typical EBITDA multiples are:

- EBITDA compared to research and development (R&D) expenses.

- EBITDA compared to sales.

- EBITDA compared to sales, general, and administrative (SG&A) expenses.

EBITDA vs. EBIT and EBT

Earnings before interest and taxes (EBIT), as mentioned earlier, is a company’s net income excluding income tax expense and interest expense. EBIT is used to analyze the profitability of a company’s core operations. The following formula is used to calculate EBIT: EBIT = Net Income + Interest Expense + Tax Expense

Example of EBITDA

For example, a company generates $100 million in revenue and incurs $40 million in cost of goods sold and another $20 million in overhead. Depreciation and amortization expenses total $10 million, yielding an operating profit of $30 million. Interest expense is $5 million, leaving earnings before taxes of $25 million. With a 20% tax rate and interest expense tax deductible, net income equals $21 million after $4 million in taxes is subtracted from pretax income. If depreciation, amortization, interest, and taxes are added back to net income, EBITDA equals $40 million.

EBITDA vs. Operating Cash Flow

Operating cash flow is a better measure of how much cash a company is generating because it adds non-cash charges (depreciation and amortization) back to net income but also includes changes in working capital, including receivables, payables, and inventory, that use or provide cash.